Bitcoin mining difficulty adjustments are a crucial mechanism that keeps the Bitcoin network functioning smoothly. These adjustments ensure that new blocks are mined approximately every 10 minutes, maintaining the consistency and security of the blockchain. However, changes in mining difficulty can have significant effects on miners and the overall network. In this blog, we’ll break down how mining difficulty works, why it adjusts, and what these adjustments mean for Bitcoin miners and the network as a whole.

What Is Bitcoin Mining Difficulty?

Bitcoin mining difficulty refers to how hard it is for miners to find a new block (solve a cryptographic puzzle) and add it to the blockchain. This difficulty level is adjusted automatically every 2,016 blocks—roughly every two weeks—to ensure that blocks are mined at a consistent rate, even as the total computational power (hash rate) of the network changes.

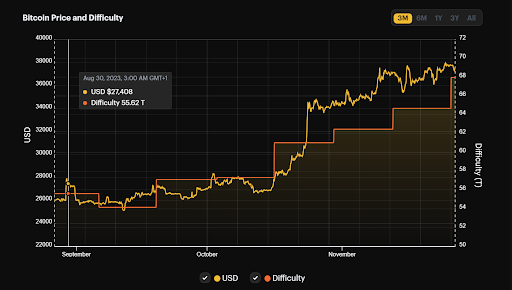

When more miners join the network, increasing the total hash rate, the difficulty level rises. Conversely, if miners leave the network, causing the hash rate to decrease, the difficulty level lowers. This self-regulating mechanism helps maintain a balance between network security and block generation speed.

How Does Bitcoin Mining Difficulty Adjust?

Bitcoin’s difficulty adjusts based on the time it took to mine the last 2,016 blocks. Ideally, it should take approximately 14 days to mine this number of blocks. If the blocks were mined faster, the difficulty increases. If it took longer, the difficulty decreases. The goal is to ensure that each block is mined in roughly 10 minutes.

This adjustment is key to keeping the Bitcoin network decentralized, as it allows miners from around the world to participate in securing the network, regardless of fluctuations in hash power.

Example: If Bitcoin experiences a surge in new miners, contributing a higher hash rate, the difficulty would increase during the next adjustment period to prevent blocks from being mined too quickly.

Why Mining Difficulty Adjustments Matter

Mining difficulty adjustments are essential for several reasons:

Ensuring Network Security: A higher mining difficulty means that more computational power is needed to mine Bitcoin. This makes it harder for any single entity or group to dominate the network and manipulate transactions, thus ensuring the security and decentralization of the Bitcoin blockchain. The more secure the network, the less vulnerable it is to attacks, such as the infamous 51% attack, where a single miner or group controls the majority of the network’s hash rate.

Regulating Block Time: Without mining difficulty adjustments, the speed at which blocks are mined would be directly linked to the total hash rate of the network. With more miners, blocks would be found faster, potentially overwhelming the network and leading to more frequent adjustments. By maintaining a consistent block time of 10 minutes, Bitcoin ensures a predictable supply of new coins and a stable blockchain operation.

Impact on Mining Profitability: Difficulty adjustments directly influence the profitability of Bitcoin mining. When difficulty increases, miners need more computational power and energy to successfully mine new blocks, which can drive up operational costs. This is particularly important for smaller mining operations that may not have the resources to compete with larger players during periods of high difficulty.

On the other hand, when difficulty decreases, miners benefit from lower competition, making it easier to mine blocks and earn rewards. This can temporarily boost profitability, especially for miners with access to low-cost electricity and efficient hardware.

The Effects of Difficulty Adjustments on Miners

Bitcoin’s difficulty adjustments can have varying effects on miners, depending on several factors, including the size of the mining operation, energy costs, and the price of Bitcoin. Here are some of the key impacts:

Increased Difficulty:

Higher Costs: As difficulty rises, miners need more powerful hardware and more electricity to keep up with the competition. This can increase operational costs and squeeze profit margins.

Greater Competition: During periods of high difficulty, the barrier to entry for smaller miners increases, making it more difficult to remain competitive against large-scale mining farms.

Potential for Lower Rewards: With higher difficulty, it takes longer for miners to solve blocks and earn rewards, potentially reducing the number of Bitcoins they can mine over a set period.

Decreased Difficulty:

Lower Competition: When difficulty drops, fewer miners are competing for block rewards, allowing those still in the game to mine more Bitcoin with the same amount of computational power.

Boost in Profitability: Decreased difficulty lowers the energy and hardware requirements for mining, improving profitability, especially for small and mid-sized miners.

Opportunity for Growth: Miners with lower operational costs or access to renewable energy can take advantage of reduced difficulty to scale their operations or upgrade their hardware.

Impact of Difficulty Adjustments on the Bitcoin Network

Mining difficulty adjustments also play a key role in maintaining the integrity and functionality of the entire Bitcoin network:

Security and Decentralization: Difficulty adjustments help protect Bitcoin from centralization. As difficulty rises, it prevents large mining operations from dominating the network too easily. In periods of decreased difficulty, it encourages more decentralized participation by making it easier for smaller miners to stay competitive.

Blockchain Stability: Regular difficulty adjustments ensure that the Bitcoin network remains stable, with a steady supply of new coins and consistent block generation times. This predictability helps to maintain user confidence in Bitcoin as a decentralized financial system.

Hash Rate Fluctuations: Mining difficulty adjustments help balance the network during hash rate fluctuations, such as after major events like China’s crackdown on Bitcoin mining. When hash rates drop significantly, difficulty adjusts downward, making it easier for remaining miners to continue securing the network.

Challenges for Miners in 2024

In 2024, miners face several challenges related to mining difficulty adjustments:

Bitcoin Halving Event: The Bitcoin halving event, expected in 2024, will reduce block rewards from 6.25 BTC to 3.125 BTC, doubling the cost per mined Bitcoin. This will make mining less profitable, especially for those with high electricity costs, and could lead to increased mining difficulty as more miners exit the market.

Rising Energy Prices: With energy costs on the rise globally, miners may face shrinking profit margins, particularly during periods of increased mining difficulty. Efficient hardware and access to renewable energy sources will be crucial for maintaining profitability.

Increased Global Competition: As more miners join the network, difficulty adjustments will continue to rise, making it harder for smaller players to compete. Large mining farms with access to low-cost energy will have a distinct advantage in maintaining profitability.

Conclusion

Bitcoin’s mining difficulty adjustments are a core feature that ensures the security, stability, and decentralization of the network. For miners, these adjustments can mean the difference between profitability and loss. As the Bitcoin ecosystem continues to evolve, miners must stay agile, invest in energy-efficient hardware, and adapt their strategies to weather both rising and falling difficulty levels. In 2024, with the upcoming Bitcoin halving and increasing global competition, mining will become even more challenging, but those who can navigate the difficulty adjustments effectively will remain profitable and vital to the network’s security.